The Taxman Cometh

High taxation near one of the country’s largest metropolitan areas shouldn’t be surprising, but according to the real estate research firm Zillow, Rockland residents shoulder one of the heaviest tax burdens in the entire nation. On average, only Westchester residents pay more “all-in” annual tax; “all-in” meaning a taxpayer’s total tab for school, town and county, and, if applicable, village and city taxes.

The question is, why? According to a recent study commissioned by the Rockland Business Association, the answer is combination of large school districts, unusually high public sector costs, changing demographics, debt from the 2013 budget crisis, and lack of political will to change the status quo.

The study was done by the non-profit research organization Pattern for Progress. Titled A Crushing Burden: Why is Rockland County so Heavily Taxed? the Pattern for Progress report crunches numbers using data from the U.S. Census, the American Community Survey, and many other state and municipal sources.

Here is a summarized list in the order of influence on your tax bill:

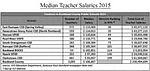

Rockland’s eight public school districts are large, and personnel costs are high. In fact, approximately two thirds of your tax bill goes towards school tax. About 65 percent of that amount is for salaries and benefits for teachers, principals, and district supervisors.

Teacher salaries are comparable to others in New York State, but administrative salaries are higher than normal. For example, in 2016-2017, Rockland will spend $27.3 million on just 152 administrative positions within the public school system.

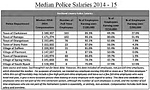

The County supports numerous town and village police departments with over 500 police officers earning over $120,000 annually. More than a third earn $150,000 and up. This is considerably higher than in other counties.

In the past few years several large companies (Mirant/NRG in Haverstraw and West Haverstraw, the Palisades Mall in Clarkstown and Pfizer in Pearl River) have won tax certiorari cases. These have required the County to pay substantial tax refunds, or to reduce future tax payments for these companies.

A fiscal crisis in 2013 resulted in a $96 million bail out from New York State. Finance charges on that debt are 10 percent of every annual budget. In 2016, $70 million was allotted for debt service. These payments are scheduled to end in 2024 or sooner when the 10-year deficit finance bond is satisfied.

Demographic and economic shifts have led to a dramatic increase in poverty rates in Rockland. For example, the Town of Ramapo has the fastest growing population in the County. It accounts for 58 percent of Rockland’s growth from 1970to the present, but it is the County’s poorest population. Medicaid enrollment has more than doubled, rising from 9.5 percent in 2000 to 24.5 percent in 2013.

About 16 percent of Rockland properties are tax exempt and account for more than $6.5 million in non-receivable taxes. Exemptions include STAR (School Tax Relief), enhanced STAR for low-income seniors, religious organizations and clergy residences.

Median household incomes have stagnated or dropped countywide since 1990.

The conclusion from Pattern for Progress is that the status quo is not sustainable. With less money coming in than going out, something has to give. Ideas floated in the report are early retirement incentives for senior police officers, consolidation of school districts, elimination or restructuring of property tax exemptions for religious organizations, and re-negotiation of public sector contracts. Any one of these actions will be radical, unpopular, and cause financial pain, but they may be unavoidable.

The best way to do more than gripe about your tax bill is to vote in local elections. No elected official will make such difficult changes without public support, and it will take an involved, informed and realistic electorate to keep that tax bill from creeping ever upwards.

To see the whole report, click on the pdf file below.

A Crushing Burden (File Size: 3 MB) 3 MB Apr. 1977 #2